Grief Education Resources

Please click on the box for appropriate grief education

resource that fits your needs.

Click here for a brochure on Grief During the COVID-19 Pandemic

Click here for brochure on Anticipatory Grief

Click here for a brochure on Grief and Bereavement

Click here for a brochure on Youth in Grief

Click here for a brochure on Anticipatory Grief

Click here for “A Dying Person’s Last Wishes” handout

Click here for “Five Things” handout

Click here for “Disenfranchised Grief” handout

Click here for “Complicated Grief” handout

Click here for a brochure on Pet Loss – Anticipatory Grief

Click here for a brochure on Pet Loss

Click on the Memory Book icon below to download a customizable, printable Memory Book.

What Now?

What to do when a loved one dies

Breathe. Regardless of the circumstances surrounding your loss, the death of a loved one can be one of the most challenging, confusing and difficult experiences we encounter throughout our lifetime. The resulting grief and related emotional experiences can be debilitating at times. Remember to take it one moment and one breath at a time.

Be self-aware. There are a wide variety of emotions you may experience and they may change often and quickly. Try to allow yourself to experience and express these emotions in healthy ways (talking, writing, emoting, etc.) rather than trying to be “strong” or to avoid or mask them. These emotions are part of a normal, natural process of grief which one experiences after a loss. The manner in which you typically experience, express and communicate emotions may or not be present during bereavement; these may be completely different during your grieving process. Know that this is not abnormal and there is no right or wrong way to grieve.

Be supported. Allow people in your life to support you. Ask those you trust to help you take care of getting things in order and planning your loved one’s memorial and/or funeral arrangements. Accepting offered support can be difficult for many people and asking for it can be even more difficult. Allow yourself to depend on others as needed throughout your grieving process.

Be patient. This is a time to be compassionate toward yourself. There are a lot of things that will need to be done following the death of a loved one. Do what you can, as you can. Allow yourself to rest and distract yourself with things that may offer you any possible relief when you are able. Honoring your needs is honoring to your loved one.

Who to contact when a loved one dies

There are many steps which must be taken in order to begin to make your loved one’s final arrangements. These tasks can sometimes be complicated and overwhelming to complete even when we are functioning at our best, let alone while we are grieving the loss of a loved one. Remember to ask for and allow yourself to receive support whenever possible. Take the time to write down everything you will need to do and begin completing one task at a time. Rest when needed. It may be helpful to write down any questions you may have prior to contacting the necessary parties. Additionally, you may also want to write down all of the names and contact information of all the individuals you work with as well as any confirmed or changed account information, arrangements agreed upon, etc. Keep all of this information in one place in order to allow easy access.

There may be many moving parts to managing your loved one’s arrangements during what can be a very emotionally, mentally and physically challenging time. Remaining organized may help to support you during this difficult time.

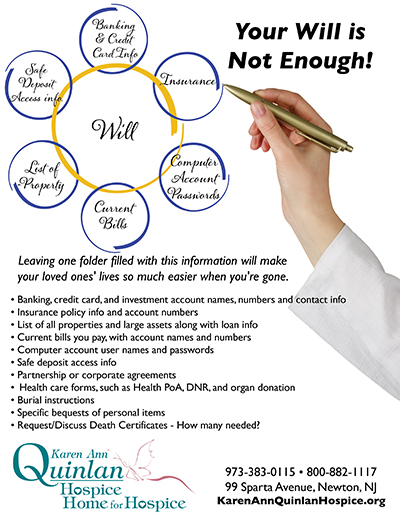

We have included some general guidelines to help you outline what needs to be done, however this list may not include all considerations of your unique situation. When you are able, it may be helpful to collect all of your loved one’s important paperwork, deeds, advanced directives, etc. in order to inventory their accounts and

• The first step will be to contact an aftercare facility (i.e., funeral home, cremation service, etc.). They will make necessary arrangements to transport your loved one to their facility in order to honor your loved one’s and family’s wishes.

• Be certain to secure and lock-up your loved one’s home and/or property, automobile(s) and any other accessible assets.

• You will need to contact the local Vital Records Office in order to acquire your loved one’s death certificate. You may need to acquire multiple certified copies in order to submit to certain account providers and institutions. While making initial contacts, be certain to ask all account providers (outlined below) if they will require a certified copy of the death certificate so you can get them all at once. Generally speaking, each major asset (i.e. car, real estate, etc.) and benefit (i.e. pension, life insurance, etc.) will require a certified copy; however, some institutions may be able to return the copy to you after the account/asset has been transferred. Some account and benefit providers may also require document verification regarding your relationship (i.e. marriage certificate, etc.) assets.

• All account providers such as insurance companies (health, life, automobile, homeowner, etc.), state and/or federal benefit (Social Security, Medicare, Veterans Affairs, etc.), utility (electricity, oil, cell, lease, online and entertainment accounts, subscriptions, etc.) should be contacted to transfer or discontinue the benefits or accounts.

• Contact your loved one’s employer regarding any employment benefits or pension plans, as applicable. Be aware you may be required to submit one copy of the death certificate per separate claim.

• Contact the local post office to inform them of your loved one’s death and inform them where to forward their mail. It may be helpful to continue to review their mail so that you may continue to monitor it for any notifications regarding other accounts, bills, etc. which you may not be aware of.

• Contact your loved one’s bank(s) and financial account providers to manage their accounts, safety deposit boxes, bonds, 401k, etc.

• Contact a probate attorney, as needed, for legal assistance surrounding asset, trust and estate management.

• Contact any identification, licensing or certification boards or institutions in order to cancel your loved one’s licenses, certifications etc. These may include your loved one’s driver’s license, notary public commission, professional licenses and/or certifications, etc.

• A tax return will most likely have to be filed, as one must be submitted annually. You may also want to consult with an accountant or tax preparer to inquire whether or not an estate tax return must be filed.

Who to turn to when a loved one dies

The people in your life who know you best and care for you can go a long way in providing support during such a difficult time. Every individual experiences loss in their own way and has their own idea of what providing support looks like. Therefore, it becomes important to tell them how they can help to support you.

Some examples of how support can be provided include regular “check-ins” and simply asking how you are, spending time with you and including you in activities or events or to be understanding if you do not feel up to participating in activities or events, offering to provide meals and/or assist in daily responsibilities (i.e.- household/yard maintenance, child supervision, etc.), reminiscing about favorite memories of your loved one or engaging in some of you and your loved

ones’ favorite activities to honor him/her. Let them know specifically how they can be a support to you and what would be most meaningful to you at this time. These needs may change over time which makes it helpful for everyone involved to continue to speak openly.

Peer support groups can be a tremendous resource during challenging times. They provide an opportunity to share your story with others as well as to hear from others who have experienced the loss of a loved one. While each individual loss and experience is unique, much can be gained from connecting through others who are also walking this road of grief.

Our group schedule can be found on our website as well as links to connect to other groups throughout the state of New Jersey. Again, in the event you cannot access our online resources, please contact our Bereavement Center to speak with our staff. (973-948-2283

In the event you find yourself continuing to struggle during your grieving process and feel you may benefit from some individual support, our Bereavement Center does offer one-on-one counseling. Sometimes it helps to talk out experiences and emotions in order to gain more explicit awareness of them.